AZG News Hub

Your go-to source for the latest news and informative articles.

Cheap Insurance: Saving Money Without the Headache

Discover how to save big on insurance without the stress! Uncover tips to find cheap coverage that fits your budget and lifestyle.

10 Tips for Finding Affordable Insurance Without Sacrificing Coverage

Finding affordable insurance can feel like searching for a needle in a haystack, but with the right strategies, it’s entirely achievable. Start your journey by comparing multiple quotes from different providers. This will give you a better understanding of the market and help you identify which companies offer the best deals without compromising on coverage. Additionally, consider seeking out discounts that might apply to your situation—such as bundling policies, maintaining a clean driving record, or being a member of specific organizations.

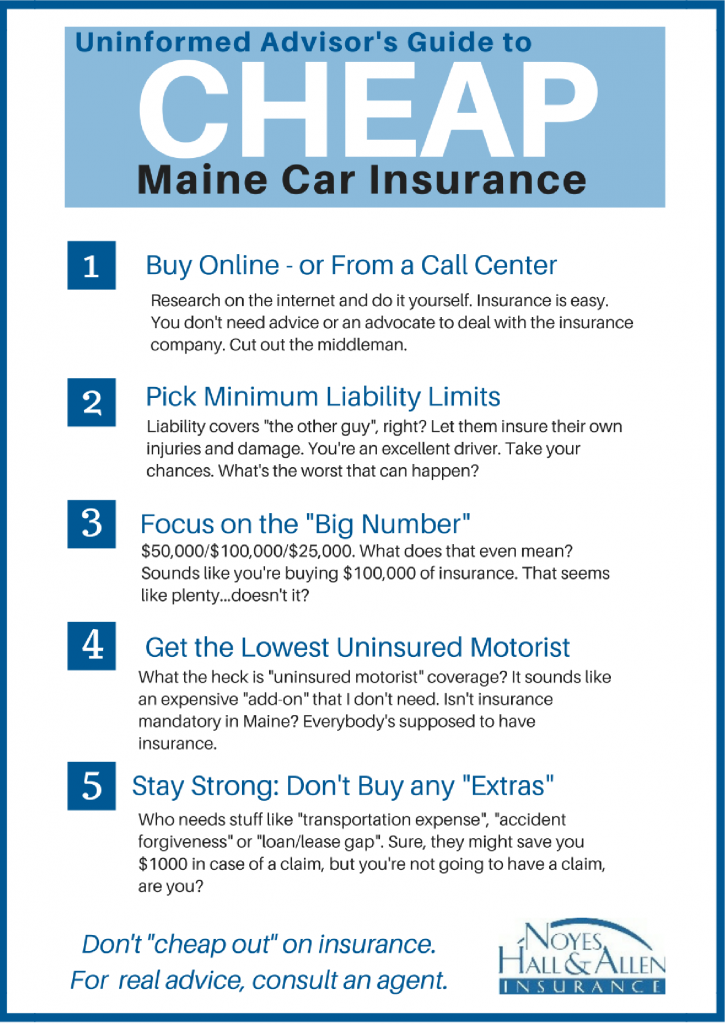

Another effective tip is to review your coverage needs regularly. Understand what you truly require by analyzing your current policy against any changes in your lifestyle. For instance, if you've downgraded your vehicle or your home value has decreased, you may not need as much coverage, which can lead to considerable savings. Finally, consult with an insurance agent who can help tailor a plan that matches your budget while ensuring you have sufficient protection.

How to Compare Insurance Quotes and Save Money Easily

When it comes to comparing insurance quotes, the first step is to gather multiple quotes from various providers. Start by assessing your coverage needs and make sure to have the same level of coverage and deductible for each quote to ensure a fair comparison. You can use online comparison tools or visit individual insurance company websites. Make a list of the key details, including premiums, coverage limits, and any additional benefits offered. This systematic approach will allow you to identify which options provide the best value for your specific needs.

After collecting the quotes, evaluate their differences carefully. It might be tempting to choose the lowest premium, but looking deeper at policy exclusions, customer service ratings, and claim handling processes is crucial. Pay attention to customer reviews and consult friends or family for recommendations. You may even consider reaching out to an insurance broker who can guide you through the complexities. By taking the time to compare thoroughly, you can make a well-informed decision that not only saves you money but also provides the coverage you truly need.

Is Cheap Insurance Worth It? Pros and Cons You Need to Know

When considering cheap insurance, it's essential to weigh the pros and cons carefully. On the positive side, affordable insurance can help individuals and families save significantly on monthly premiums, allowing them to allocate funds towards other essential expenses. Additionally, basic coverage can still provide adequate protection against unforeseen events, such as accidents or illnesses, particularly for those on tight budgets. However, it's crucial to note that cheap insurance often comes with higher deductibles, limited coverage options, and less comprehensive benefits, which might lead to out-of-pocket costs during a claim.

On the flip side, choosing cheap insurance may pose risks that aren't immediately apparent. Customers might find themselves underinsured when unexpected incidents arise, leading to substantial financial burdens in the long run. Furthermore, many low-cost policies have restrictions that can hinder claims processes or result in denied claims. Before opting for cheap coverage, consider conducting thorough research and evaluating whether the savings truly outweigh the potential downsides. This balanced approach can ensure that you make an informed decision that aligns with your financial and protection needs.