AZG News Hub

Your go-to source for the latest news and informative articles.

Bargain Insurance: Your Wallet Will Thank You

Discover how to save big on insurance without sacrificing coverage. Your wallet will thank you—unveil the secrets to bargain insurance today!

Top 5 Tips for Finding Affordable Insurance Without Sacrificing Coverage

Finding affordable insurance without compromising on coverage can seem daunting, but with the right strategies, it can be manageable. Here are the top 5 tips to guide you:

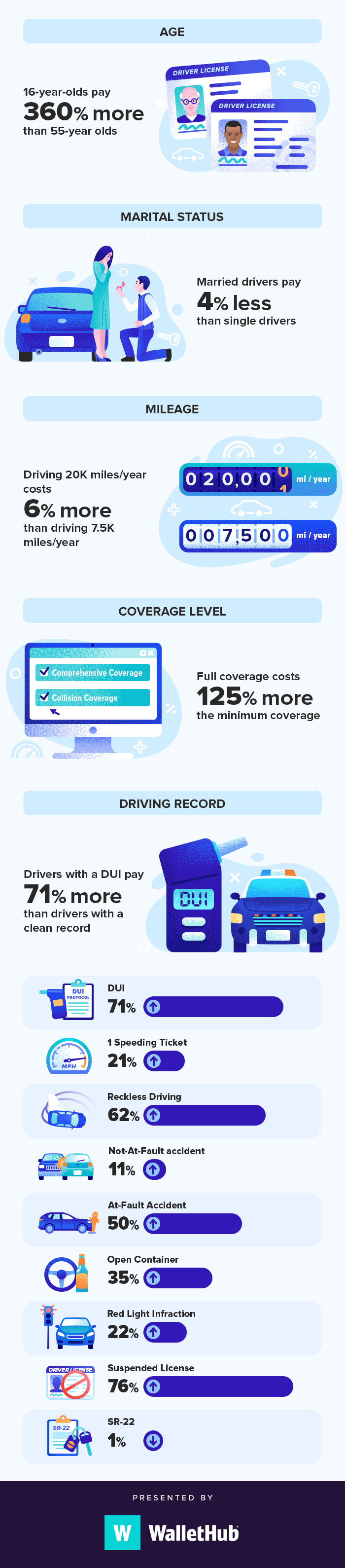

- Compare Quotes: Utilize online tools to compare quotes from multiple insurers. This helps you identify the best price without sacrificing necessary coverage.

- Understand Your Needs: Assess your coverage requirements to avoid over-insuring. Knowing what you really need can lead to better decisions.

- Bundle Policies: Consider bundling your insurance policies for discounts. Many companies offer lower rates when you purchase multiple types of insurance together.

- Improve Your Credit Score: A higher credit score can lead to reduced premiums. Take steps to improve your credit rating to lower your insurance costs.

- Seek Discounts: Always ask about available discounts. Many insurers offer reduced rates for safer driving, a good academic record, or even loyalty.

Bargain Insurance vs. Traditional Policies: What's the Real Difference?

When considering Bargain Insurance versus Traditional Policies, it's essential to understand the core differences that can significantly impact your coverage and financial security. Bargain Insurance often focuses on providing minimal coverage at a reduced premium, appealing to budget-conscious consumers. However, this can lead to unforeseen gaps in protection, especially in critical situations where comprehensive coverage is necessary. On the other hand, Traditional Policies typically offer broader coverage options, ensuring that policyholders have more substantial protection against a wide range of risks, albeit at a higher cost.

The choice between Bargain Insurance and Traditional Policies ultimately depends on individual needs and preferences. Those seeking affordable premiums might be tempted by bargain options, but they should consider the trade-offs, including potential out-of-pocket expenses during claims. To make an informed decision, individuals should evaluate their lifestyle, the value of their property, and their financial ability to absorb costs. In summary, while Bargain Insurance can save money upfront, Traditional Policies often provide peace of mind with more extensive protection from unexpected events.

How to Understand the Fine Print: What Cheapest Insurance Plans Won't Tell You

When exploring the world of insurance, it's crucial to understand the fine print that often accompanies the cheapest insurance plans. Many consumers get lured in by attractive premium rates, but the terms and conditions can contain hidden clauses that may leave them vulnerable in times of need. For instance, exclusions on specific types of coverage, such as natural disasters or pre-existing conditions, can turn an initially appealing policy into a financial burden. It's essential to thoroughly read and comprehend these details to avoid unpleasant surprises down the line.

Additionally, cheapest insurance plans frequently come with lower coverage limits or higher deductibles that can significantly impact your out-of-pocket expenses. To put this into perspective, if you choose a plan with a low monthly premium but a high deductible, you may find yourself facing substantial costs before your coverage kicks in. Always assess the trade-offs between premium costs and coverage benefits. It's worth investing time to compare multiple plans, ensuring you get a policy that not only fits your budget but also offers adequate protection when you need it most.