AZG News Hub

Your go-to source for the latest news and informative articles.

Pet Insurance: Because Unexpected Vet Bills Are Ruff

Protect your wallet from surprise vet bills! Discover how pet insurance can save you money and keep your furry friend healthy.

Understanding Pet Insurance: What Coverage Do You Need?

When it comes to pet insurance, understanding the available coverage options is crucial for making an informed decision. Pet insurance typically offers three main types of coverage: accident-only plans, illness plans, and comprehensive plans. Accident-only plans cover injuries resulting from accidents, while illness plans provide coverage for veterinary treatments related to illnesses. Comprehensive plans combine both accidents and illnesses, often including additional features such as preventive care.

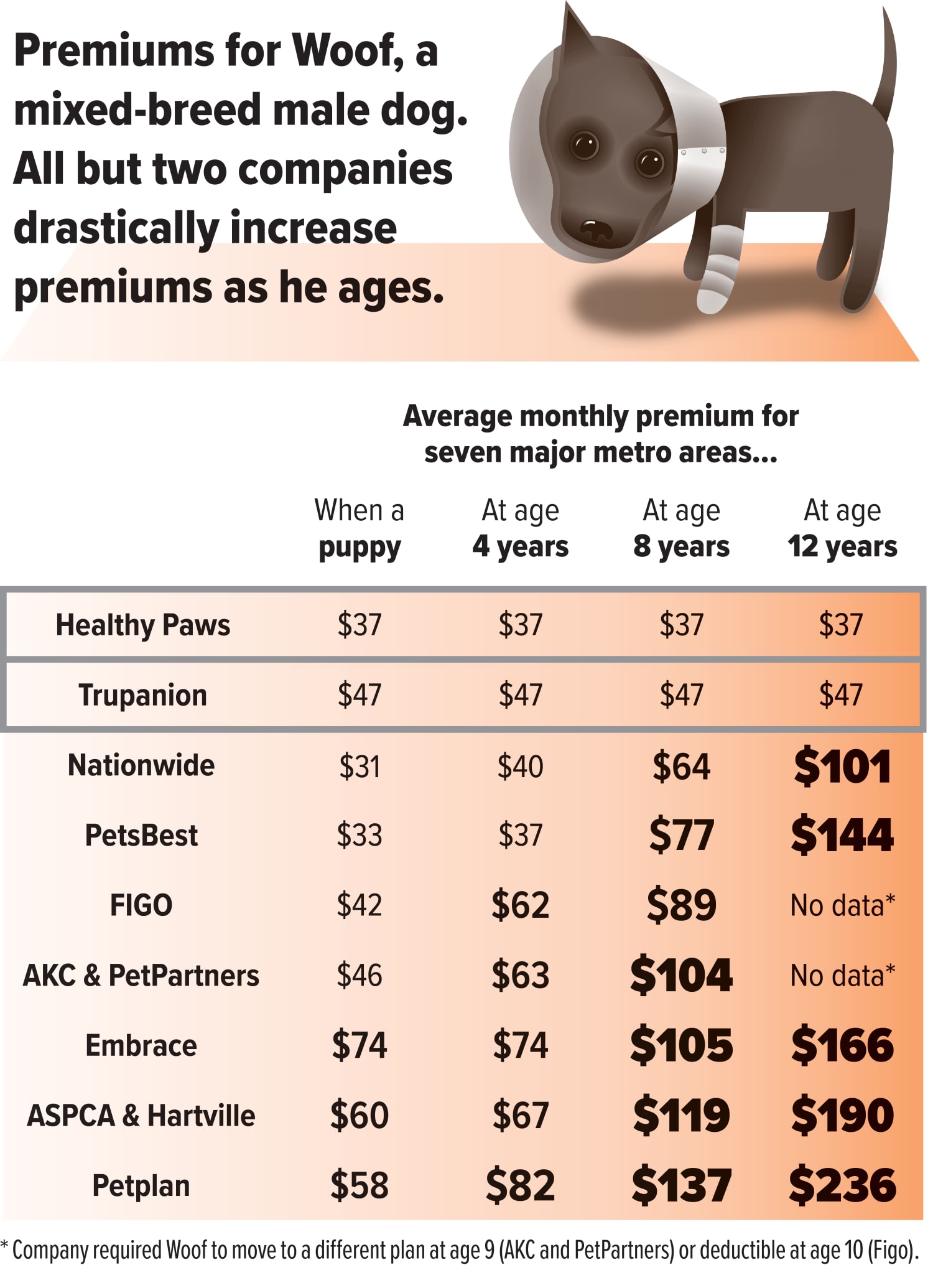

Choosing the right coverage depends on several factors, including your pet's age, breed, and medical history. It's also essential to consider your budget and whether you prefer to pay lower monthly premiums with a higher deductible or vice versa. Many policies include exclusions, so be sure to carefully read the terms to avoid surprises. By assessing your pet's unique needs and comparing various pet insurance providers, you can find the appropriate coverage that ensures your furry friend receives the best care possible.

Top 5 Reasons Why Pet Insurance is a Smart Investment

Investing in pet insurance is becoming increasingly vital for modern pet owners, and here are five compelling reasons why it's a smart investment. First, unexpected veterinary bills can quickly add up, especially in emergency situations. With insurance, you can protect yourself from high costs associated with surgeries, treatments, and medications. Second, having pet insurance can provide peace of mind. Knowing that you're financially covered for your furry friend's health issues allows you to focus on their recovery without the stress of expenses.

Third, many pet insurance plans offer flexibility in choosing veterinary clinics, meaning you can prioritize the best possible care without being restricted by your budget. Fourth, regular check-ups and preventive care often become more manageable under a pet insurance plan, as many policies cover vaccinations and routine examinations. Lastly, pet insurance can significantly improve your pet’s quality of life, allowing for prompt treatments that increase their chances of a full recovery. Consider these factors carefully and see how pet insurance can be a beneficial choice for you and your beloved companion.

Is Pet Insurance Worth It? Common Questions Answered

Pet insurance is a topic that many pet owners grapple with, especially when considering the rising costs of veterinary care. Is pet insurance worth it? The short answer is that it often depends on your individual circumstances. Factors such as your pet's age, breed, and health history play a significant role in determining whether or not you'll recoup the costs of insurance. Generally, younger pets who are healthy at the time of enrollment can benefit the most, as they are less likely to have pre-existing conditions that can complicate coverage.

Common questions arise, including what types of conditions are covered under a typical pet insurance policy. While policies vary, most will cover accidents, illnesses, and sometimes routine care. It's essential to read the fine print and understand any exclusions or limitations. Additionally, many pet owners wonder about the financial aspect: Is pet insurance worth it? Consider the potential savings in case of an unexpected accident or illness, which can amount to thousands of dollars. Ultimately, evaluating your pet's needs and your financial situation will help you make an informed decision.