AZG News Hub

Your go-to source for the latest news and informative articles.

Crypto Staking Systems: Where Your Coins Take a Vacation and Earn on the Side

Discover how to make your crypto work for you! Learn about staking systems where your coins relax and grow richer while you unwind.

What is Crypto Staking and How Does It Work?

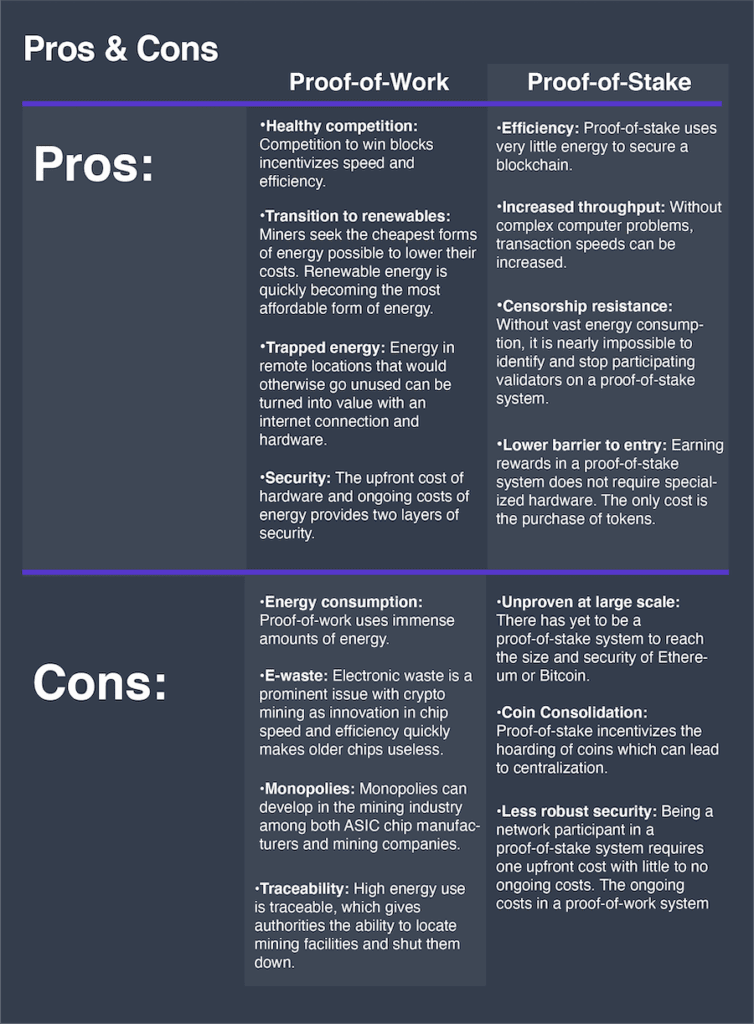

Crypto staking is the process of participating in a proof-of-stake (PoS) blockchain network by locking up a certain amount of cryptocurrency to support the operations of the network. When users stake their tokens, they contribute to the security and efficiency of the blockchain, allowing for faster processing of transactions and greater decentralization. In return for staking their assets, participants typically earn rewards in the form of additional coins or tokens, making it an attractive investment strategy for those looking to grow their crypto portfolios.

The staking process involves several key steps:

- Choosing the Right Cryptocurrency: Not all cryptocurrencies support staking, so it’s essential to do your research and select one that aligns with your investment goals.

- Setting Up a Wallet: You’ll need a compatible crypto wallet to store your coins securely and facilitate staking.

- Staking Your Coins: Once your wallet is ready, you can stake your coins, usually for a predetermined period, during which your funds are locked and cannot be accessed.

- Receiving Rewards: After the staking period, you’ll receive your staking rewards, which can be reinvested or withdrawn.

Counter-Strike is a popular first-person shooter game that emphasizes teamwork and strategy. Players choose to fight as either terrorists or counter-terrorists, engaging in various missions such as bomb defusal and hostage rescue. For gamers looking for an exciting twist, you can check out the rollbit promo code to enhance your gaming experience.

Maximizing Your Earnings: Tips for Successful Crypto Staking

Maximizing your earnings through crypto staking requires a strategic approach. Start by understanding the various staking mechanisms available, such as Delegated Proof of Stake (DPoS) or Proof of Stake (PoS). It is crucial to research and choose a reliable cryptocurrency that offers attractive staking rewards. For beginners, consider staking stablecoins or established cryptocurrencies for lower risks. Additionally, always stay updated on the staking requirements and rewards, as these may change over time. Effective decision-making will significantly impact your potential earnings.

Moreover, diversifying your staking portfolio can help mitigate risks and maximize your returns. Instead of putting all your assets into a single staking option, consider the following tips:

- Allocate funds across multiple cryptocurrencies.

- Review the historical performance of each asset.

- Participate in community discussions to gain insights.

- Consider using staking calculators to project your earnings.

By applying these strategies, you can ensure that your crypto staking ventures remain profitable and minimize the impact of market volatility on your investments.

Is Crypto Staking Worth It? Exploring the Risks and Rewards

Is Crypto Staking Worth It? To answer this question, one must first understand what staking entails. Staking involves locking up a certain amount of cryptocurrency in a wallet to support the operations of a blockchain network, such as transaction validation and security. In return for this support, participants are rewarded with additional cryptocurrency. However, while the potential rewards can be enticing—often yielding annual returns between 5% and 15%—there are inherent risks that every investor should consider. For instance, the volatility of the crypto market can lead to significant fluctuations in the value of the staked asset, potentially offsetting any rewards accrued.

Moreover, staking comes with risks beyond mere price volatility. One substantial risk is the possibility of being locked into a staking period during which you cannot access or sell your cryptocurrency. This liquidity risk can disadvantage investors who might need immediate access to their assets in response to unfavorable market conditions. Additionally, there are risks associated with the staking platform itself, including security vulnerabilities and the potential for fraud. As you deliberate whether crypto staking is worth it, conducting thorough research and assessing your risk tolerance are crucial. Ultimately, a well-informed decision can help you navigate the unpredictable waters of crypto investment while maximizing potential rewards.