AZG News Hub

Your go-to source for the latest news and informative articles.

Riding the Crypto Rollercoaster: How Market Volatility Shapes Your Digital Wallet

Discover how market volatility impacts your digital wallet and learn to navigate the thrilling ups and downs of cryptocurrency!

Understanding the Basics: What Causes Cryptocurrency Market Volatility?

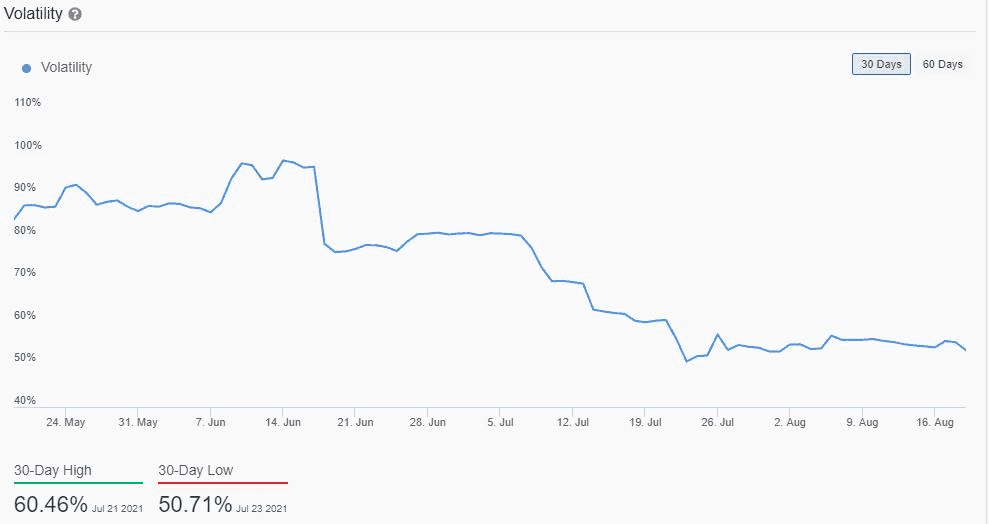

The cryptocurrency market is known for its extreme volatility, which can leave both new and experienced investors feeling overwhelmed. Several key factors contribute to this rapid price fluctuation. First and foremost, the speculative nature of cryptocurrencies often leads to sharp price movements. Investors frequently buy and sell based on market trends, news, and social media hype, which can create a chain reaction that amplifies price swings. Additionally, the relative immaturity of the market itself, alongside limited liquidity compared to traditional markets, further exacerbates these fluctuations.

Another major contributor to cryptocurrency market volatility is regulatory uncertainty. Governments around the world are still developing frameworks to manage and control cryptocurrencies, creating unpredictability for investors. News of new regulations or crackdowns can prompt immediate reactions in the market, leading to sudden surges or drops in prices. Furthermore, the overall market sentiment, influenced by factors such as macroeconomic trends and technological advancements, plays a crucial role in shaping investor confidence and, ultimately, market stability.

Counter-Strike is a highly popular first-person shooter game that pits teams of terrorists against counter-terrorists in various objective-based scenarios. Players can team up to strategize and outplay their opponents, making use of a variety of weapons and tactics. For those looking to enhance their gaming experience, consider using a cloudbet promo code to unlock exciting rewards.

Top Strategies for Managing Your Digital Wallet During Market Fluctuations

In today's volatile financial landscape, managing your digital wallet effectively during market fluctuations is crucial for safeguarding your assets. One of the top strategies is to diversify your investments across various cryptocurrencies and digital assets. By spreading your investments, you can mitigate risks associated with market dips. Additionally, consider utilizing automated tools to monitor price changes, such as alerts or bots, which can help you make timely decisions and capitalize on favorable market conditions.

Another key strategy for managing your digital wallet is to maintain a disciplined approach to buying and selling. Establish clear guidelines for when to sell or hold your assets based on market analysis and your financial goals. Furthermore, setting aside a portion of your portfolio in stablecoins can provide balance during market turbulence, allowing you to preserve capital while still participating in potential growth opportunities. In summary, by diversifying your assets and maintaining a disciplined buying strategy, you can navigate market fluctuations more effectively.

Is Your Crypto Portfolio Prepared for a Market Crash?

In the volatile world of cryptocurrency, a market crash can happen when you least expect it. It’s crucial to assess whether your crypto portfolio is prepared for such downturns. Start by diversifying your investments across various cryptocurrencies to mitigate risks. Rather than putting all your funds into a single coin, consider a mix of established assets like Bitcoin and Ethereum, combined with promising altcoins. This balanced approach not only spreads your risk but also positions you to capitalize on potential rebounds in different sectors of the market.

Moreover, implementing a strategy for risk management is essential. Utilize tools such as stop-loss orders to safeguard your investments during turbulent times. Additionally, keep a close eye on market trends and news, as these can provide valuable insights into potential movements. By staying informed and adaptive, you can better protect your crypto portfolio from significant losses and ensure you are ready to take advantage of opportunities when the market recovers.