AZG News Hub

Your go-to source for the latest news and informative articles.

Riding the Rollercoaster: How Crypto Market Volatility Shapes Investor Strategies

Discover how crypto market ups and downs influence investor strategies. Get insights and tips to navigate the volatile world of cryptocurrency!

Understanding the Basics of Crypto Volatility: What Every Investor Should Know

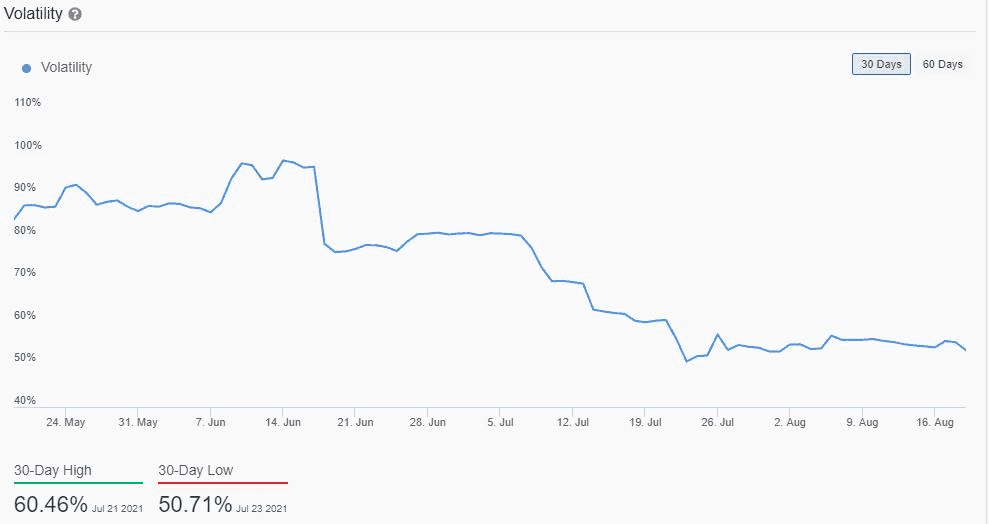

Crypto volatility refers to the rapid and significant price fluctuations commonly associated with cryptocurrencies. These fluctuations can be influenced by various factors, including market sentiment, regulatory news, and technological advancements. Understanding these aspects is crucial for investors, as high volatility can lead to both substantial profits and catastrophic losses. To navigate this unpredictable landscape, investors must familiarize themselves with key principles of market behavior and trends, as well as the psychological factors that can drive price changes.

One important concept to grasp is how crypto volatility differs from traditional markets. While stocks and bonds often exhibit steadier price movements, cryptocurrencies can experience dramatic swings in value within short time frames. For instance, a sudden surge in interest or a negative news report can lead to drastic changes within a few hours. Therefore, it is essential for investors to develop strong risk management strategies and be prepared for potential ups and downs. By doing so, they can mitigate risks while taking advantage of the opportunities that arise in this dynamic market.

Counter-Strike is a highly popular first-person shooter game that has captivated millions of players around the world. It features team-based gameplay where players can choose to be terrorists or counter-terrorists. If you're looking to enhance your gaming experience, don't forget to check out the cloudbet promo code for some exciting bonuses!

Strategies for Navigating Market Swings: How to Invest Wisely in Cryptocurrency

Investing in cryptocurrency can feel daunting, especially during periods of high market volatility. However, having a well-defined strategy can help you navigate these market swings wisely. First, consider diversifying your portfolio. Instead of focusing solely on one cryptocurrency, invest in a mix of established coins like Bitcoin and Ethereum along with promising altcoins. This approach can mitigate risks while allowing you to benefit from different market movements. Additionally, setting clear buy and sell thresholds can help you make objective decisions rather than emotional ones during turbulent times.

Another essential strategy is to stay informed. Regularly follow cryptocurrency news and market analyses to understand the factors driving price fluctuations. Utilize resources such as technical analysis and sentiment indicators to gauge market trends. Consider adopting a long-term perspective; often, short-term gains can be tempting, but cryptocurrency investment is typically more rewarding over time. Lastly, don't forget to reassess your investment strategy periodically. The cryptocurrency market is ever-changing, and adjusting your approach can help you adapt to and thrive in this volatile environment.

Is It Time to Panic? Managing Emotions During Crypto Market Downturns

In the often volatile world of cryptocurrency, downturns are an inevitable reality that can evoke intense emotions among investors. When the market dips, fear and uncertainty can lead to impulsive decisions that may exacerbate losses. Instead of succumbing to panic, it's essential to adopt a calm and calculated approach. Focus on understanding that market fluctuations are part of the investing landscape. Maintain a clear perspective by reviewing historical trends and recognizing that many successful investors have weathered downturns by staying informed and disciplined.

To effectively manage emotions during these challenging times, consider implementing the following strategies:

- Stay Informed: Keep abreast of market news and developments that can impact prices.

- Diversify Investments: Spread your investments across various assets to mitigate risk.

- Avoid Rush Decisions: Take time to analyze the situation before making any trades.