AZG News Hub

Your go-to source for the latest news and informative articles.

The Sleuth of the Blockchain: Uncovering Truths with On-Chain Transaction Analysis

Unveil the secrets of blockchain with our ultimate guide to on-chain transaction analysis. Discover hidden truths and insights now!

Exploring On-Chain Analysis: How to Decode Blockchain Transactions

On-chain analysis refers to the process of examining blockchain transactions to gain insights into the behavior of users and the overall health of cryptocurrency networks. By decoding blockchain transactions, analysts can uncover valuable information such as transaction patterns, wallet activities, and more. This type of analysis can be crucial for investors seeking to make informed decisions, as on-chain data often provides clear signals about market trends, the movement of large holders, and network usage. Additionally, this transparency can help in identifying potential security threats or deficiencies within a blockchain ecosystem.

To efficiently perform on-chain analysis, several tools and techniques can be employed. Here are some key elements to consider:

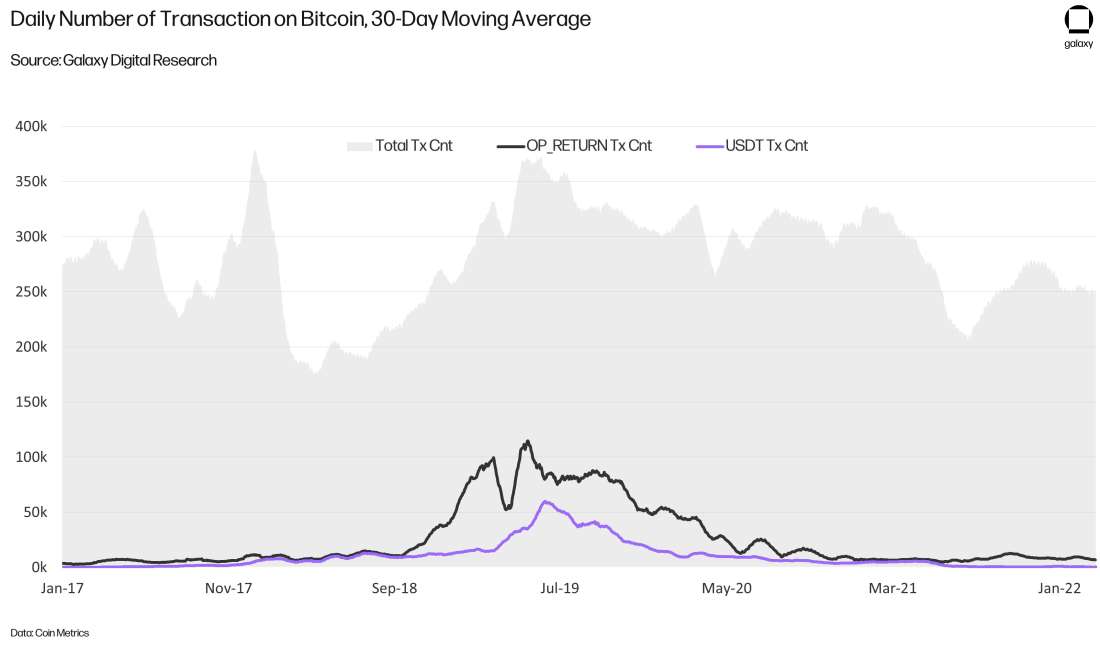

- Transaction Volume: Monitoring the volume of transactions over time can indicate the level of activity within the network.

- Active Addresses: Analyzing the number of active wallets helps to assess user engagement and adoption rates.

- Network Fees: Changes in transaction fees can signal shifts in demand and network congestion.

By leveraging these factors, users can decode nuances in blockchain transactions and enhance their understanding of the evolving digital asset landscape.

Counter-Strike is a popular tactical first-person shooter that has captivated gamers since its release. Players engage in team-based combat, with one team typically taking on the role of terrorists and the other as counter-terrorists. For those looking to enhance their gaming experience, using a bc.game promo code can provide exciting bonuses and rewards.

The Role of Transaction Analysis in Enhancing Blockchain Transparency

Transaction analysis plays a crucial role in enhancing blockchain transparency by providing insight into the flow of digital assets. By examining the details of transactions recorded on the blockchain, stakeholders can trace the origins and destinations of cryptocurrency movements, ensuring accountability and fostering trust within the ecosystem. This analysis often involves identifying patterns of activity, which can highlight irregularities that may indicate fraudulent behavior or misuse of funds. As a result, entities such as financial institutions, regulatory bodies, and individual users can leverage transaction analysis to make informed decisions and maintain the integrity of the blockchain.

Moreover, the efficacy of transaction analysis is amplified by innovative technologies like machine learning and data visualization tools. These technologies enable analysts to sift through vast amounts of blockchain data more efficiently, uncovering trends and anomalies that might otherwise go unnoticed. By embracing a collaborative approach that includes all blockchain participants, from developers to end-users, transaction analysis not only bolsters blockchain transparency but also encourages a proactive stance towards improving security measures and enhancing regulatory compliance across the industry.

Common Questions About On-Chain Analytics: What You Need to Know

On-chain analytics is a vital tool for understanding the dynamics of blockchain transactions. As the technology underlying cryptocurrencies and decentralized applications continues to evolve, many users find themselves asking how these analytical methods work and their benefits. To begin with, on-chain analytics involves examining data recorded on the blockchain, such as transaction history, wallet addresses, and smart contracts, to derive insights about user behavior, market trends, and network health. This data can provide crucial information for investors, developers, and researchers alike, helping them make informed decisions and strategic plans.

Common questions about on-chain analytics often revolve around its accuracy and the types of analyses it supports. For example, individuals frequently inquire about the difference between on-chain and off-chain data analytics. While on-chain analytics focuses on publicly available blockchain data, off-chain analytics includes data from exchanges, social media, and other sources that may not be as transparent. Understanding these distinctions is key to utilizing both forms of analysis effectively. It's also essential to recognize that on-chain analytics can uncover patterns in transaction flows, identify large holders of cryptocurrencies (also known as 'whales'), and track the flow of funds across multiple addresses, allowing users to stay informed in a rapidly changing landscape.